Big Boss M5 Insights

Your source for the latest news and tips on technology and innovation.

Digital Wallet Integrations: The Secret Sauce to Effortless Transactions

Unlock seamless transactions with digital wallet integrations! Discover the secret sauce for effortless payments and elevate your online experience today!

Understanding Digital Wallet Integrations: How They Transform Transactions

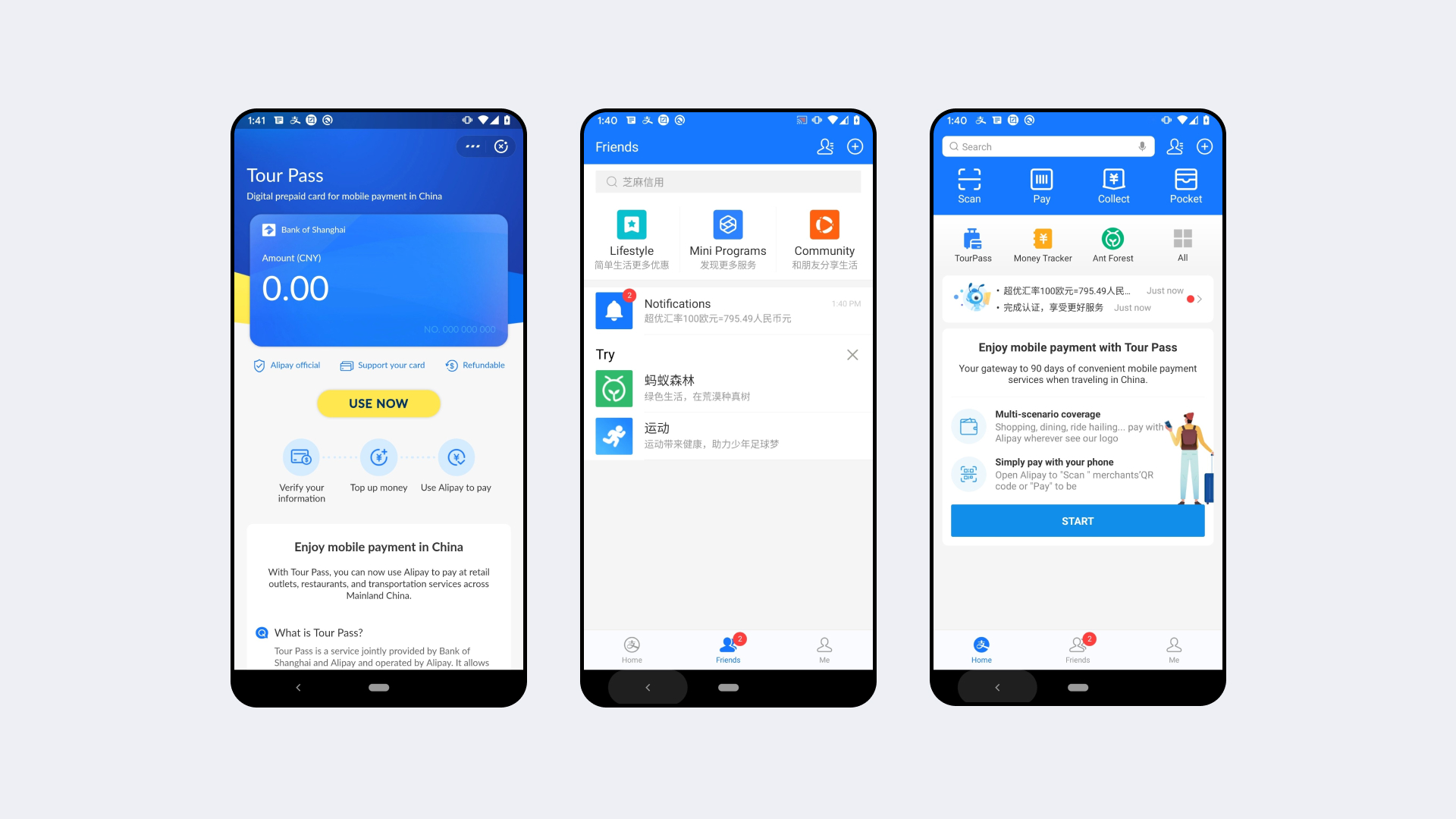

Understanding Digital Wallet Integrations is crucial in today’s fast-paced digital economy. Digital wallets, such as PayPal, Apple Pay, and Google Wallet, allow consumers to store their payment information securely and streamline the transaction process. Integrating these wallets into various platforms transforms the way businesses approach transactions, offering a seamless experience.

One of the most significant benefits of digital wallet integrations is their ability to enhance user experience by reducing the barriers to purchase. By enabling customers to check out with just a few clicks, businesses can significantly lower shopping cart abandonment rates. Additionally, these integrations ensure that transactions are not only fast but also secure, building trust with consumers and encouraging repeat business.

Counter-Strike is a highly competitive first-person shooter game that has gained immense popularity since its release. Players can join various game modes, and for those looking to make the experience even more exciting, using a betpanda promo code can enhance gameplay.

Top Benefits of Implementing Digital Wallet Solutions for Your Business

In today's fast-paced digital marketplace, implementing digital wallet solutions can tremendously benefit your business by streamlining transactions and enhancing customer experiences. By offering digital wallet options, you not only attract tech-savvy consumers but also improve transaction speed, which can lead to higher customer satisfaction and retention rates. With features such as contactless payments and easy fund transfers, your customers will appreciate the convenience these solutions provide, making it more likely for them to return for future purchases.

Moreover, adopting digital wallet solutions can significantly reduce operational costs for your business. Traditional payment processing methods often come with high transaction fees, but digital wallets typically offer lower fees, allowing you to allocate funds more efficiently. Additionally, implementing these solutions can enhance security through advanced encryption techniques, protecting both your business and your customers' sensitive information. By leveraging digital wallets, not only do you bolster your financial efficiency, but you also build trust with your clientele.

What You Need to Know About Securing Your Digital Wallet Integrations

As digital payments become increasingly prevalent, securing your digital wallet integrations is essential for maintaining the safety of your financial information. A digital wallet, whether on a smartphone or a computer, typically connects to various payment methods and personal data, making it a prime target for cybercriminals. To protect your assets, it’s crucial to implement strong security measures. Start by using complex passwords and enabling two-factor authentication (2FA) to add an extra layer of protection. Regularly update your software and applications to ensure you have the latest security patches, and be cautious about sharing your personal information online.

Moreover, it’s vital to evaluate the digital wallet integrations you choose. Opt for well-established providers known for their robust security practices. Look for wallets that utilize encryption to protect your sensitive data. Additionally, ensure that your wallet of choice complies with the latest security standards and regulations. To further enhance security, consider using a firewall and antivirus software. Staying informed about potential phishing scams and fraudulent activities can also help you spot threats early. By taking these steps, you can significantly improve the security of your digital wallet and enjoy peace of mind when making transactions.